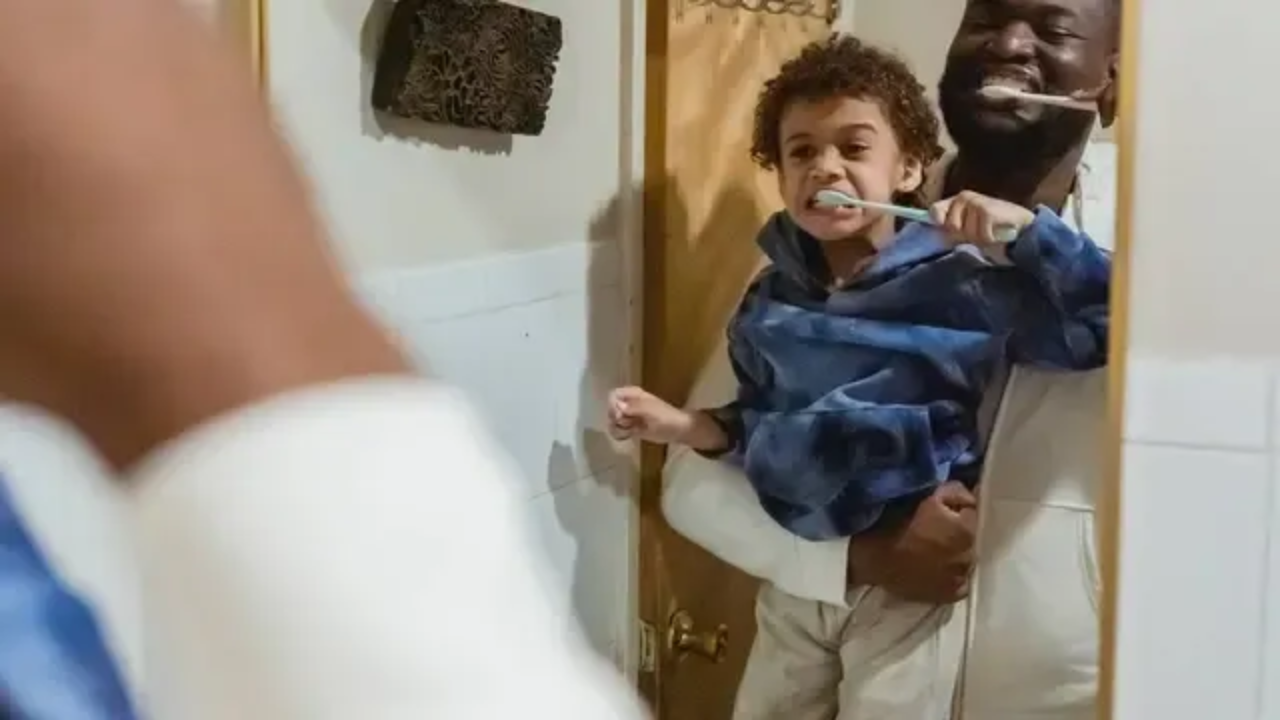

Building Generational Wealth: How to Start Talking About Money With Your Kids

Dec 20, 2022Let’s face it, talking about money can be awkward. Couples across the country struggle to communicate about finances, coworkers don’t know how to discuss their salaries, and parents don’t know how to talk about money with their kids. Financial taboo has swept the nation, and in its place, we’ve found overwhelming levels of stress and an alarming lack of financial education.

How we discuss money with our kids dramatically impacts our relationships and how we handle money at home. At a foundational level, building wealth is a process of making goals for your money and sticking with consistent habits to accomplish those goals over time. If we are to build wealth that lasts for generations, we have to find better ways to talk about money.

Start Talking About Money With the End in Mind

When talking about money, start with the end in mind. Anytime you approach a financial conversation, remember why you’re talking in the first place. What are you trying to accomplish in the end? Keeping the end in mind can help us communicate more clearly and have more patience. It can also prevent stress by allowing us to focus on the intention of the conversation without getting caught up in the emotions financial stress can bring.

Building Financially Healthy Kids

Talking to kids about money now can have a massive impact on their financial life down the road. Most kids have set money beliefs by the age of 7, meaning they already have fixed feelings around money and how to handle it in the future. When you talk to your child about money now, the goal is to create financially capable humans equipped with “enough” wealth at the end. Good communication at home can not only prevent financial stress but can also help you teach your kids healthy habits with money for life.

Building Communication Pathways

Communication takes practice and patience. Building different pathways to talk about money helps you learn what works for you while giving you different tools to communicate about money with others - whether you’re talking to your partner about financial goals or your child about how money works.

Talking to kids about money can be a process of trial and error, but sticking with a few different approaches can help you find a rhythm to teaching your child about money and how they can holistically build wealth.

Starting the Conversation

Many parents feel they need to be more financially put together before discussing money with their kids. In most cases, just starting the conversation with positive intentions and a willingness to learn is more than enough. We all start somewhere, but we can grow together.

Consider using basic prompt questions that focus the conversation. For example, talking to your kids about money can start with:

- What would you like to do with money? Why?

- What can money do for us? How does money help us?

- What would be the best way for you to make money? How much money do you think the most incredible jobs make?

Building Positive Money Relationships at Home

How you talk about money and interact with money at home sets the stage for building a more positive relationship with money and your kids. When you set the intention of making more positive money relationships, you can find ways to incorporate that attitude throughout your home. Consider:

- Family money game night: Pull out Monopoly or create your own game. Build a more positive rhythm at home and create easy conversation starters about money or future goals.

- Grocery shopping and meal planning: Get your partner and kids involved in grocery planning for a practical way to talk about money. Plan a budget together and make a mission of creating the best menu without going over.

- Cooking: Besides meal planning, cooking can be a fun activity that shows you exactly where your money goes and the value it provides. Understanding the value of food and the quantities used in cooking can help foster a more healthy relationship with money and food.

- Money management: Bring a positive perspective to money management at home. Get the family involved in planning a future vacation or setting family goals to help build more positive rhythms with money.

Incorporating Financial Literacy and a Habit of Learning

Investing in healthy money habits with your kids now will help them succeed for a lifetime. Even if you don’t have thousands of dollars to invest in accounts for your child right now, you can still help them build wealth by starting with communication. Teaching kids how to understand money and talk about finances regularly is a great foundation they’ll use for life. Ways to create a habit of financial learning include:

- Asking new money questions one day each week (like the prompts from above)

- Play a coin and cash recognition game with young kids

- Play online money games for kids

- Take online financial literacy courses or other structured online learning

Navigating Awkward Conversations

A big part of communicating about money is learning how to control our reactions. Sometimes a conversation gets heated, or your child asks a question you don’t know how or necessarily want to answer. Learning to control our reactions and respond with curiosity can help us navigate awkward conversations without losing our cool. If your child wants to know if you have a million dollars, flip the question back with curiosity. “It sounds like you really want to be a millionaire someday… how do you think you could make that happen?”

Building generational wealth starts with better communication about money. We can learn new ways to communicate and build those pathways into new habits supporting our biggest financial dreams. Building a foundation of good communication starts at home and spreads throughout your life. Setting an example of a healthy relationship with money can positively impact your partner, your kids, your career, and your entire financial future.

For more support on your journey to building generational wealth, check out resources like My First Million Mind Map for kids or more ideas on how to teach your kids about money on the blog.

Photo by Keira Burton: https://www.pexels.com/photo/black-father-and-son-brushing-teeth-in-bathroom-6624467/

Questions: email [email protected]

Mariah Hudler, MSW, MBA, CFT-I™ is a therapeutically informed financial wealth & wellbeing coach. She works with individuals, couples, families, entrepreneurs, groups, and organizations to make Wealth & Wellbeing a joyful part of life.

Disclaimer: This blog is for education only. Please consult with a qualified professional when you have any questions about your personal financial, tax, or legal situation. Information contained in this post is for informational purposes only and not intended to replace professional advice.

Build your balance with my monthly newsletter!

I hate SPAM. I will never sell your information, for any reason.